Did you know that there are a lot of advantages to having an electric car in the UK?

Besides having zero emissions, taking care of the environment, and saving fuel money, you would be surprised that you would be saving on your taxes by simply having an electric car.

Yup. You read that right. Taxes!!!

Should you buy an electric car this year until 2024 or if you already have bought one, you are entitled to a free road tax benefit by the UK government. Yes. Free. No road tax. Nothing. Not even a single pence.

Yes, you read that correctly: in 2022-2023, you will not be required to pay any money for road tax (VED) on a completely electric vehicle. The government is currently offering zero-road-tax incentives to owners who choose zero-emission vehicles.

What Is “Road Tax”

Every year, the owners of every motor vehicle that is utilised on the highways pay a tax. This is the general term for what a road tax is.

However, road tax was abolished in the 1930s. Currently, general taxation, not specifically VED, covers the expense of maintaining the UK’s roadways. This is a personal tax that most car owners must pay based on the carbon dioxide emissions produced by their vehicles.

What most people call road tax is a tax on cars, not roads, and it goes straight into the general Treasury fund. Many government agencies have now started calling VED “car tax” but it might be classified as a pollution tax since it’s now based on the size of the engine and emissions.

Now that we have clarified what road tax is, we’ll look at why having an electric car is road tax-free.

UK Incentives For EVs

The UK gives incentives, subsidies and grants to EVs as part of its 2035 strategy to ban petrol and diesel-fueled vehicles. The UK has subsidized EVs. New purchases of electric cars are given up to £1500 of discount by manufacturers paid for by the UK government.

The UK has earmarked about £300 million for EV subsidies alone for the next 5-7 years. Besides the discounts, the government has given some tax reliefs for electric vehicles.

Check to see if a car has current vehicle tax or has been declared off the road (SORN). The records can take up to 5 working days to update according to gov.UK’s website

CO2 Emissions-Based Tax

UK road tax is a tax on CO2 emissions. The heavier your car’s CO2 emissions are, the bigger the tax. The system puts a bracket on the amount of CO2 the car emits in grams per kilometre (g/km) and on the number of years the car has been used.

Taking this definition, fully electric vehicles don’t have CO2 emissions. It would be on the zero emissions bracket which would put its tax at £0. The UK, with its 2030 goal, is not keen on changing this zero emissions rule, for now. This simply means, at least soon,” No emissions, no tax.”

It would need to change, though. As petrol and diesel cars will soon be banned, the UK cannot afford to go taxless on electric cars for so long. There will be an estimated 32 Million EVs by 2030 and not getting road tax (or whatever taxes on these cars) would mean millions, maybe billions of income for the government.

File Your Taxes Even If They Are Exempt

Even though your car is exempt from certain taxes, you should still file them. Paperwork must be done regardless of the exemption. Even though there is no charge, you must tax your vehicle when you purchase it and renew your electric car road tax every 12 months.

Congestion Charges

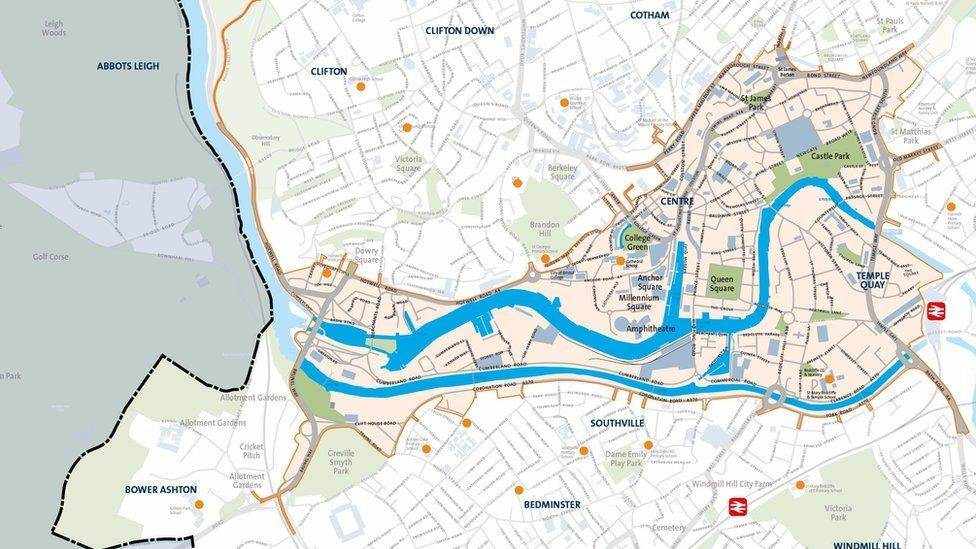

Congestion charges are also waived for electric vehicles. Anyone considering a trip to a clean-air zone will appreciate this.

Clean Air Zones

A Clean Air Zone is an area where specific measures are made to improve air quality. It might be a single street or a section of a city.

In these zones, vehicles that do not meet the emission standards would be fined a fee. The schemes are being implemented in parts of the UK as part of the government’s long-term strategy to improve air quality across the country and tackle the climate emergency.

It wants to discourage the use of older, more polluting vehicles, to reduce the number of areas in the UK where air pollution breaches legal limits.

Following this principle, fully electric cars which produce zero will have no worries about getting in and out of Clean Air Zones. At the basic level, electric cars are technically exempt from clean air charges, or even ultra-low emission zones charges. EVs just don’t have emissions to start with.

Subsidies On Electric Cars

Cars with CO2 emissions of less than 50 grams per kilometre are also eligible for a full year of capital allowances and or government subsidies. This means that you can deduct the entire cost of an electric vehicle from your pre-tax profits. The deduction is about 19% of the total cost of the electric car pre-tax.

This may result in a tax reduction of about £5,900 in the first year on a car costing roughly £30,000. That’s a huge tax cut and a lot of savings for the owners

Business Benefits Of Electric Cars

Businesses may save a lot of money and get a lot of advantages when they use electric automobiles.

BiK Rate Reduction

Employers have always been able to provide corporate cars as a perk when recruiting new staff. However, rising Benefit-in-Kind (BIK) tax rates — the tax an employee must pay for obtaining this benefit, based on a vehicle’s fuel type, CO2 emissions, and personal income tax percentage – have slowed acceptance in recent years.

BIK rates for corporate cars now start at 2% for electric cars, 23% for the cleanest hybrids, and 25% for any car with 100 g/km CO2. In other words, the greater the vehicle’s BiK rate, the more polluting it is.

When an employee obtains a car from their employer for personal use, it is considered a taxed ‘perk.’ The computation for BiK is a bit complex. Looking at the percentages alone, an electric-only has 2% BiK rates (2022-2025 rates) while a petrol-fueled car goes from 25% and gives as high as 37% based on its carbon emissions.

This is a huge pay reduction for both the employees and the employers. The government desires to put petrol cars out of the UK and this is a huge step in getting businesses involved.

The electric car benefit-in-kind tax on pure EVs has been raised from 1% in April 2021–2022 to 2% in April 2022–2023. Vehicles with lower emissions (up to 50g/km, 130+ mile range) that are registered before April 6, 2020, will have their BIK rate locked at 2% until April 2023.

Other Benefits To Businesses

Companies can benefit from a range of subsidies and other incentives to assist them make the conversion to electric, in addition to the 0% VED and BIK rate reduction. Think about this scenario:

For vans, a plug-in subsidy of up to £8,000 is available, saving 20% on the cost of a qualifying low-emission vehicle.

An electric car that satisfies specific conditions may be eligible for a discount of up to £3,000 off the purchase price.

The Office for Low Emission Vehicles (OLEV) will pay up to £20,000 of the purchase price of a qualifying large van or truck if you place one of the first 200 orders.

Should Electric Vehicles Be Taxed In The Future?

Knowing all of these benefits of electric cars and the exemption on road taxes, should electric vehicles be taxed in the future?

We think so. There’s a whole lot of government income that will be lost due to the 2030 ban on petrol cars.

Electric car drivers in the UK will not be able to enjoy cheap road tax indefinitely, according to experts.

In reality, road tax and fuel charges might cost the Treasury £35 billion each year, accounting for 4% of total tax revenue.

Using electric cars is a big win for the environment. Looking at the figures though, electric cars would starve the economy, a big 4% of the economy. Without fuel excise taxes, fuel-related income, and even clean air charges, government funds would dwindle by a hefty sum.

Alternatives should take effect soonest so as not to affect the economy as the government puts its zero-emission goal closer to home. There are ideas on how to charge taxes on electric cars or charging stations, but everything is preliminary. We will update our readers once there are certain changes in place

Learn More About EVs

Still in the dark about EVs? Do you have a few questions about electric charge points? Don’t know where and how to start switching to a zero-emission, battery-powered ride?

Head to our website for everything EV! Contact us now and we can also help you with your electric charger needs.